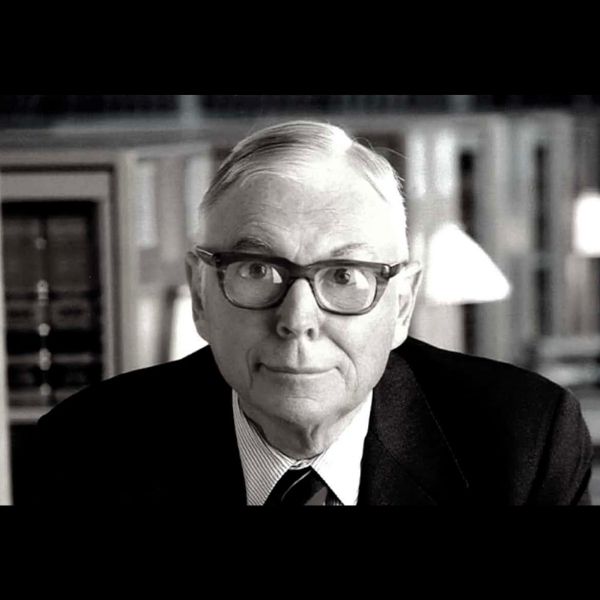

When discussing the financial titans of our age, one name invariably emerges from the echelons of investment wisdom: Charlie Munger. The very utterance of “Charlie Munger net worth” evokes astonishment, admiration, and curiosity in equal measure. A partner to the legendary Warren Buffett and the Vice-Chairman of Berkshire Hathaway, Munger’s investment acumen and principles have played an instrumental role in steering the conglomerate to its zenith.

The fascination surrounding “Charlie Munger net worth” isn’t merely due to the staggering numbers, but also the journey behind it. His rise wasn’t an overnight sensation. It was a product of decades of dedication, astute decision-making, and an unyielding commitment to value investing. Many financial enthusiasts and budding investors have, at some point, pondered upon “Charlie Munger net worth,” not just to marvel at the figures but to understand and perhaps emulate the principles that engineered such wealth.

In this article, we will delve deep into the tapestry of Munger’s life and career, tracing the evolution of the much-discussed “Charlie Munger net worth.” From his early days in Omaha to his formidable partnership with Buffett, each chapter of his life offers invaluable lessons and insights into the world of finance, business, and value creation.

Charlie Munger Net Worth Timeline

To comprehend the magnitude of Charlie Munger’s wealth, it’s pivotal to trace the trajectory of his net worth over the years.

- 1960s: Munger’s journey in the world of finance was already underway, but it was in this decade that he collaborated with Warren Buffett, setting the foundation for Berkshire Hathaway’s growth. While exact figures are hard to pin down, it’s known that Munger’s net worth began its upward trajectory due to his legal and real estate ventures, compounded by his early investments.

- 1980s: By this time, Berkshire Hathaway had made some pivotal investments in companies like Coca-Cola and GEICO. Munger’s stake in the company, coupled with his own investments, pushed his net worth to the hundreds of millions. It was clear he wasn’t just riding Buffett’s coattails but was an instrumental part of the investment decisions.

- 2000s: As Berkshire Hathaway’s stock continued its meteoric rise, so did Munger’s net worth. His diversified investment strategy, including direct holdings in companies and stock market plays, saw him join the billionaire’s club.

- 2010s: With Berkshire stock performing robustly and Munger’s personal investment endeavors reaping rewards, estimates suggested his net worth hovered between $1.5 to $2 billion. His philanthropic efforts also gained prominence during this period, with significant donations to educational institutions.

- 2020s: Charlie Munger’s net worth was estimated to be around $2.2 billion, a testament to his investment acumen and the compounding power of long-term holdings.

- 2023: Charlie Munger’s net worth was estimated to be around $2.5 billion as Forbes Realtime Billionaire List

It’s essential to remember that while net worth figures are fascinating, they only scratch the surface of Munger’s multifaceted journey in the financial realm.

About Personal Biography

Charlie Munger, born on January 1, 1924, in Omaha, Nebraska, is more than just the Vice-Chairman of Berkshire Hathaway; he is a symbol of perseverance, wisdom, and calculated risk in the investment world. His Midwestern roots played a significant role in shaping his values, and his early experiences, both triumphs and tribulations, forged the man we recognize today.

Educated initially at the University of Michigan, Munger’s academic journey was briefly interrupted by World War II. He served as a meteorologist in the U.S. Army Air Corps. Upon returning, he chose not to go back to Michigan, instead opting for Harvard Law School, from which he graduated with a Juris Doctor.

Interestingly, Munger did not begin his professional life in the world of finance. He was an accomplished lawyer and had his own law practice. However, his passion for investing and the financial markets was undeniable. This passion drew him away from law and towards the investment world, a transition that would soon prove to be transformative not just for Munger, but for the myriad of investors who’d come to admire and follow his philosophies.

In the personal realm, Munger’s resilience was evident. He faced personal tragedies, including the death of his first wife, but displayed remarkable strength and grace in such times. His life story is a blend of ambition, hard work, and an unyielding dedication to continuous learning. Today, many recognize him for his wealth and investment acumen, but those who’ve delved deeper know that Charlie Munger’s true wealth lies in his vast repository of wisdom and the legacy he’s building through his deeds and teachings.

Salary and Investment

Charlie Munger’s stature in the financial world is monumental, and while his salary and investment strategies have been pivotal in shaping his net worth, they also offer an intriguing insight into his financial philosophies.

Salary: At Berkshire Hathaway, both Munger and Buffett have been known for their modest salaries compared to other executives of similar caliber. As of recent data, Munger’s annual salary from Berkshire was a mere $100,000. This might seem surprising to many, given his pivotal role in the company. However, it underlines his and Buffett’s belief that the real wealth for company executives should come from stock holdings in the company they serve, aligning their interests directly with shareholders.

Investment: Munger’s investment strategy, while aligned with Buffett’s value investing principles, has its unique nuances. He is an advocate of the “latticework of mental models” approach, believing in integrating knowledge from various disciplines to make better investment decisions.

- Berkshire Hathaway: A significant chunk of Munger’s net worth is tied to his stake in Berkshire Hathaway. This long-term holding has been a cornerstone of his wealth creation.

- Daily Journal Corporation: Munger serves as the chairman of this publishing company, and his strategic investments through the company, especially during the 2008 financial crisis, have proven highly lucrative.

- Direct Holdings: Beyond these, Munger has been known to hold direct stakes in various companies, both in and outside of Berkshire’s portfolio. His choices reflect a deep understanding of the business, a belief in its management, and an assessment of its long-term potential.

The combination of a modest salary and astute investments underscores Munger’s belief in the power of compounding and long-term value creation. His strategies serve as a masterclass in patient, intelligent investing

Early Life

Charlie Munger’s early years laid the foundation for the titan of industry he would become. Born in Omaha, Nebraska, to Alfred D. Munger and Florence Munger, he grew up during the Great Depression, an era that left an indelible mark on his perspectives about money, value, and resilience.

As a young boy, Munger exhibited a proclivity for numbers and was known to be an avid reader. This thirst for knowledge was a trait that would stay with him throughout his life. His father, a lawyer, and his mother played influential roles in shaping his character, instilling in him the values of hard work, integrity, and continuous learning.

His formative education took place at Omaha’s Central High School. Even in his school years, Munger showed signs of entrepreneurial spirit. One summer, he and a friend operated a business where they rented out a plot of land to sell soft drinks to workers, showcasing an early knack for spotting opportunities.

World War II intervened in his college years. Before he could complete his studies at the University of Michigan, he enlisted in the U.S. Army Air Corps, serving as a meteorologist. This stint in the military imbued him with discipline and a broader worldview.

Post the war, Munger’s decision to attend Harvard Law School without an undergraduate degree was a testament to his determination and brilliance. His time at Harvard further honed his analytical skills, setting the stage for his later foray into the world of investments.

While Munger’s name today is synonymous with financial acumen and wisdom, his early life, filled with challenges, learning, and perseverance, serves as a reminder of the journey that led to his remarkable achievements.

Career

The financial prowess of Charlie Munger is a culmination of a diverse and enriching career path. Far from being a linear trajectory into the world of finance, Munger’s career spanned multiple disciplines, each contributing to his vast reservoir of knowledge and experience.

Law to Investment: Starting as a lawyer, Munger established himself in the legal profession with his own firm, Munger, Tolles & Olson. However, the allure of the financial markets and the potential for wealth creation drew him away from law. Transitioning from law to managing investments, Munger established an investment partnership in the early 1960s, which boasted impressive returns under his stewardship.

Berkshire Hathaway: His collaboration with Warren Buffett, a fellow Omaha native, marked a pivotal point in his career. While both had crossed paths earlier, it was in the 1970s that Munger formally joined Berkshire Hathaway as its Vice-Chairman. The duo’s synergistic approach, with Buffett’s value investing principles and Munger’s multidisciplinary insights, transformed Berkshire from a struggling textile company into a global investment conglomerate.

Other Ventures: Beyond Berkshire, Munger’s career included significant roles in other corporations. He became the Chairman of the Daily Journal Corporation, a publishing and software firm. Under his leadership, the company not only flourished in its core business but also made strategic investments, further elevating its value.

Philosophy and Teachings: Munger’s career wasn’t just about making lucrative investments. He became an influential voice in the investment community, known for his candid wisdom and insights. His lectures, especially the ones at the University of Southern California, provided budding investors with invaluable lessons on rational thinking, ethics, and the importance of lifelong learning.

Charlie Munger’s illustrious career stands as a testament to his versatility, intelligence, and the ability to adapt and grow, making him one of the most respected figures in the global finance landscape

Professional Journey

While Munger’s career offers a broad overview of his roles and achievements, his professional journey delves deeper into the ethos, principles, and decisions that characterized his approach to business and investing.

Value Investing: Munger is often associated with the principle of value investing, a philosophy he shares with Warren Buffett. However, he brought his own unique perspective to it. For Munger, investing was not just about numbers; it was about understanding the intrinsic value of a business, its competitive advantage, and its potential for long-term growth.

Mental Models: One of the cornerstones of Munger’s investment philosophy is the concept of “mental models.” He believed in integrating knowledge from various disciplines – from psychology to physics – to make better investment decisions. This multidisciplinary approach allowed him to view opportunities and challenges through different lenses, often leading to more informed and rational decisions.

Ethics in Business: Munger placed a high premium on ethics and integrity. He often emphasized the importance of doing right by the shareholders and operating with a moral compass. For him, short-term gains achieved through dubious means were not worth the long-term damage to reputation and trust.

Philanthropy: As his wealth grew, so did his commitment to giving back. Munger’s professional journey is also marked by his significant philanthropic contributions, especially in the field of education. He believed in the transformative power of education and donated generously to institutions that shared his vision.

Continuous Learning: Munger’s professional life was a testament to his belief in continuous learning. Even at the pinnacle of his career, he was known to be an avid reader, always curious, always looking to expand his knowledge base.

In essence, Charlie Munger’s professional journey is a masterclass in rationality, ethics, and the pursuit of knowledge – principles that have guided him in his multifaceted roles and endeavors.

Personal life

Charles Thomas Munger, born in Omaha, Nebraska, on January 1, 1924, is not just a name in the world of business and investment; he’s a towering figure whose influence resonates profoundly in the corridors of global finance. At the age of 99, his journey and achievements stand as a testament to perseverance, intellect, and strategic acumen.

Munger holds the esteemed position of Vice Chairman at Berkshire Hathaway, a global conglomerate renowned for its diverse investments and unwavering growth. Warren Buffett, the chairman of Berkshire Hathaway and one of the most celebrated investors of all time, doesn’t merely see Munger as a colleague. Instead, he often refers to him as his closest partner and right-hand man, a testament to their synergy and shared vision.

However, beyond the boardrooms and investment portfolios, Munger’s life has been rich and varied. His educational journey is an impressive one, having attended the California Institute of Technology and then moving on to the University of Michigan. He furthered his academic pursuits at Harvard University, eventually earning his law degree from Harvard Law School in 1948.

On the familial front, Munger has had two marriages. His first wife was Nancy Huggins, with whom he tied the knot in 1945, and they were together until 1953. Later, in 1956, he married Nancy Barry, and their union lasted until 2010. His family is quite extensive, blessed with six children: Charles T. Munger, Jr., Molly Munger, Emilie Munger Ogden, Wendy Munger, Philip R. Munger, and Barry A. Munger. Each of them, in their own right, has had noteworthy journeys and accomplishments.

Munger’s family roots trace back to his parents, Alfred C. Munger and Florence Munger. He also has siblings, Carol Munger and Mary Munger, with whom he shares childhood memories and bonds of kinship.

Aside from his corporate achievements and family, Munger is also a philanthropist, ensuring that a part of his considerable net worth, which stood at 2.5 billion USD in 2023 as reported by Forbes, is channeled towards causes and initiatives that aim at creating positive societal impacts.

Social Contact Details

In today’s digital age, social media and online platforms have become essential tools for influential figures to connect with the public, share insights, and maintain an online presence. However, Charlie Munger, with his old-school approach and preference for privacy, is somewhat of an exception.

Berkshire Hathaway Communications: For those seeking insights from Munger, the annual Berkshire Hathaway shareholder letters, co-authored with Warren Buffett, are invaluable. These letters often contain wisdom, investment perspectives, and glimpses into the duo’s thinking. The Berkshire Hathaway official website is the primary source for these communications.

Public Appearances and Interviews: Over the years, Munger has made several public appearances, particularly at the annual Berkshire Hathaway shareholder meetings. These meetings, often dubbed the “Woodstock for Capitalists,” are broadcasted live and are accessible to the public. Additionally, he occasionally gives interviews to financial news outlets, providing deep insights into current economic situations and investment strategies.

Books and Publications: For those eager to delve deeper into Munger’s philosophies, several books and publications capture his wisdom. Notable among them is “Poor Charlie’s Almanack,” which is a compilation of his speeches, insights, and philosophies.

Frequent Asked Question Related to Charlie Munger:

How did Charlie Munger amass his wealth?

A: Munger’s wealth primarily stems from his long-term investments in Berkshire Hathaway and his stake in the company. His astute investment strategies, both through Berkshire and personally, as well as his ventures like the Daily Journal Corporation, contributed to his immense net worth.

What is the investment philosophy of Charlie Munger?

A: Munger is a staunch advocate of value investing, emphasizing the importance of understanding a company’s intrinsic value. He also believes in the “latticework of mental models,” integrating knowledge from various disciplines to make informed investment decisions.

Has Charlie Munger written any books?

A: While Munger hasn’t authored traditional books, “Poor Charlie’s Almanack” stands out as a compilation of his talks, thoughts, and philosophies. The book offers invaluable insights into his investment strategies and life principles.

How is Charlie Munger related to Warren Buffett?

A: Munger and Buffett aren’t related by blood but share a deep professional bond and friendship. Both hail from Omaha, and their paths crossed multiple times before Munger formally joined Berkshire Hathaway as Vice-Chairman. Together, they transformed the company into a global investment powerhouse.

What are Munger’s views on modern technology and start-ups?

A: While Munger acknowledges the transformative power of technology, he’s been cautious about diving into tech investments without fully understanding the business. He’s expressed skepticism about the high valuations of some start-ups and emphasizes the importance of sustainable, long-term business models.

How active is Charlie Munger in philanthropy?

A: Munger is deeply committed to philanthropy, with a focus on education. He’s made significant donations to various institutions, including Stanford University and the University of Michigan, supporting student housing, libraries, and scholarships.

Why is Munger often referred to as Warren Buffett’s “right-hand man”?

A: As Vice-Chairman of Berkshire Hathaway, Munger has played a pivotal role in the company’s investment decisions and strategies. His collaboration with Buffett has been synergistic, combining Buffett’s value investing principles with Munger’s multidisciplinary approach. This partnership has earned him the title of Buffett’s “right-hand man.”

What is Munger’s advice for budding investors?

A: Munger often emphasizes the importance of continuous learning, understanding the businesses you invest in, and thinking long-term. He advises against chasing short-term gains and underscores the value of patience, integrity, and rationality in investment decisions

Share with your friends!

Anne R. Jacinto is an engaging writer with a zest for blending literary insight with digital trends. Keen on research, she delves into global events and the stories behind influential figures, offering readers a glimpse into the lives of celebrities worldwide.